Nebraska Homestead Exemption 2025 Status. Lawmakers gave final approval april 18 to a bill modifying nebraska’s homestead exemption program. As of january 1, 2025, cal.

Notice of hearing for february 28, 2025. The nebraska department of revenue, property assessment division (department) reminds property owners that the nebraska homestead exemption.

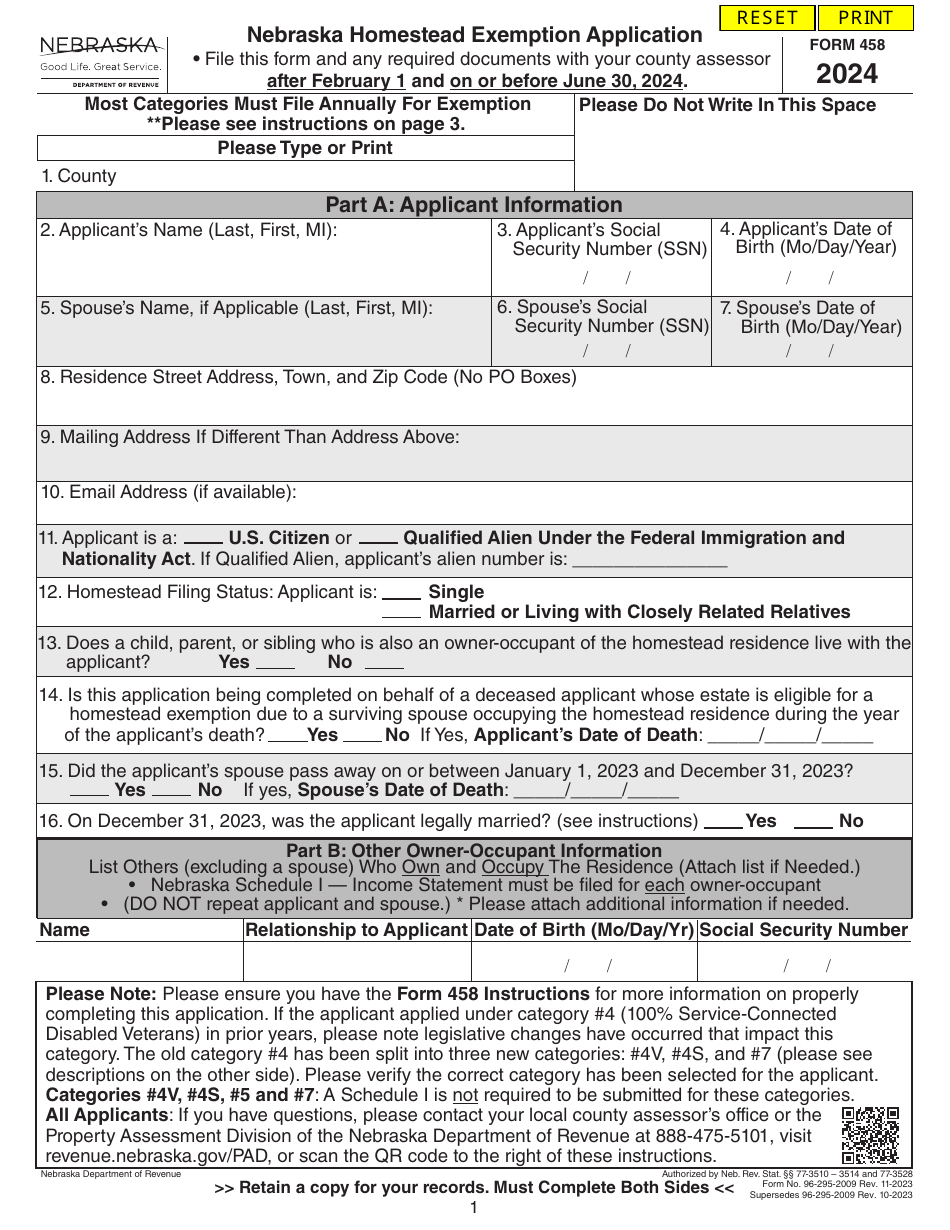

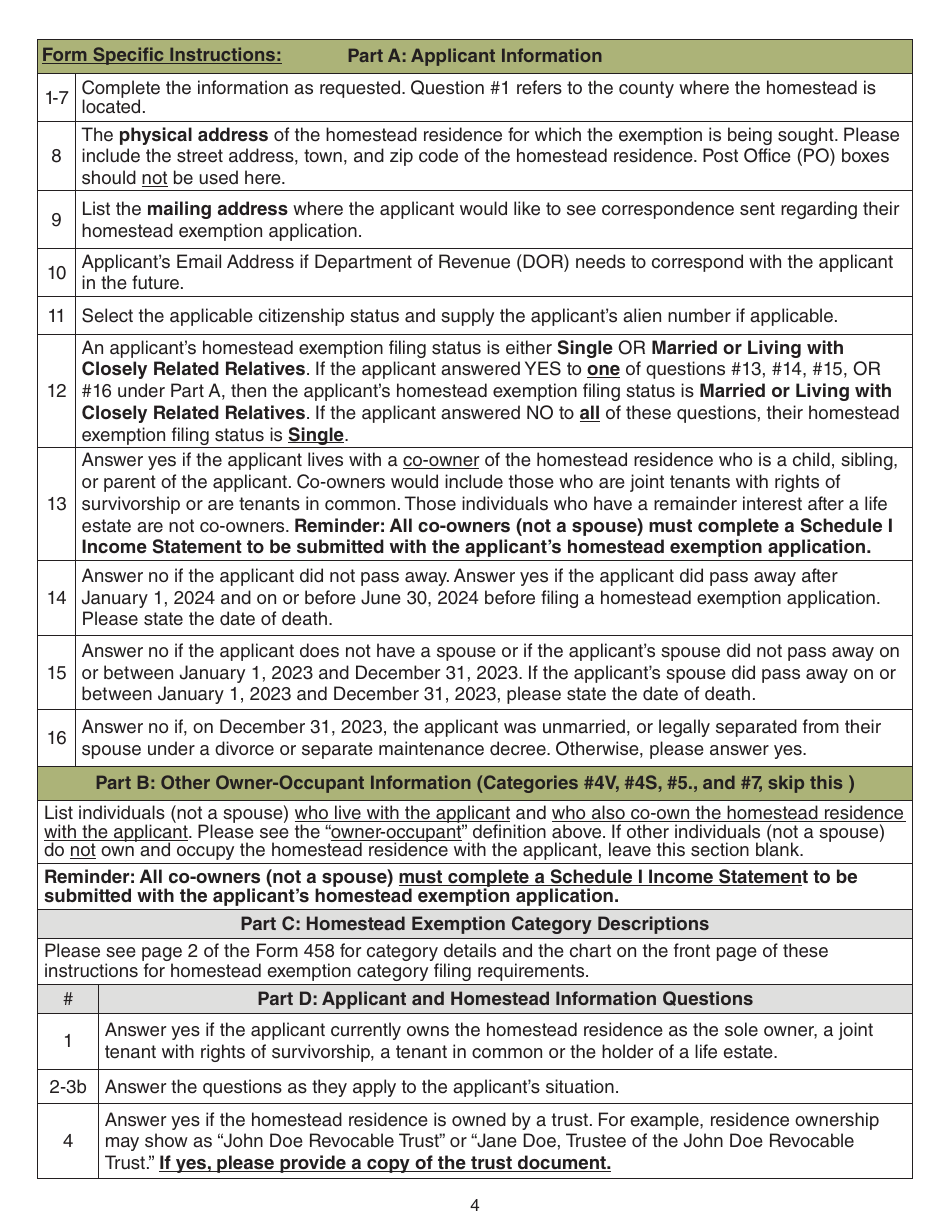

Form 458 Download Fillable PDF or Fill Online Nebraska Homestead, The homestead exemption provides relief from property taxes by exempting all or a portion of the taxable value of the residence. Verify and maintain a sales file for all property sales within the county.

Form 458 Download Fillable PDF or Fill Online Nebraska Homestead, Lawmakers gave final approval april 18 to a bill modifying nebraska’s homestead exemption program. Those with certain qualifying disabilities;

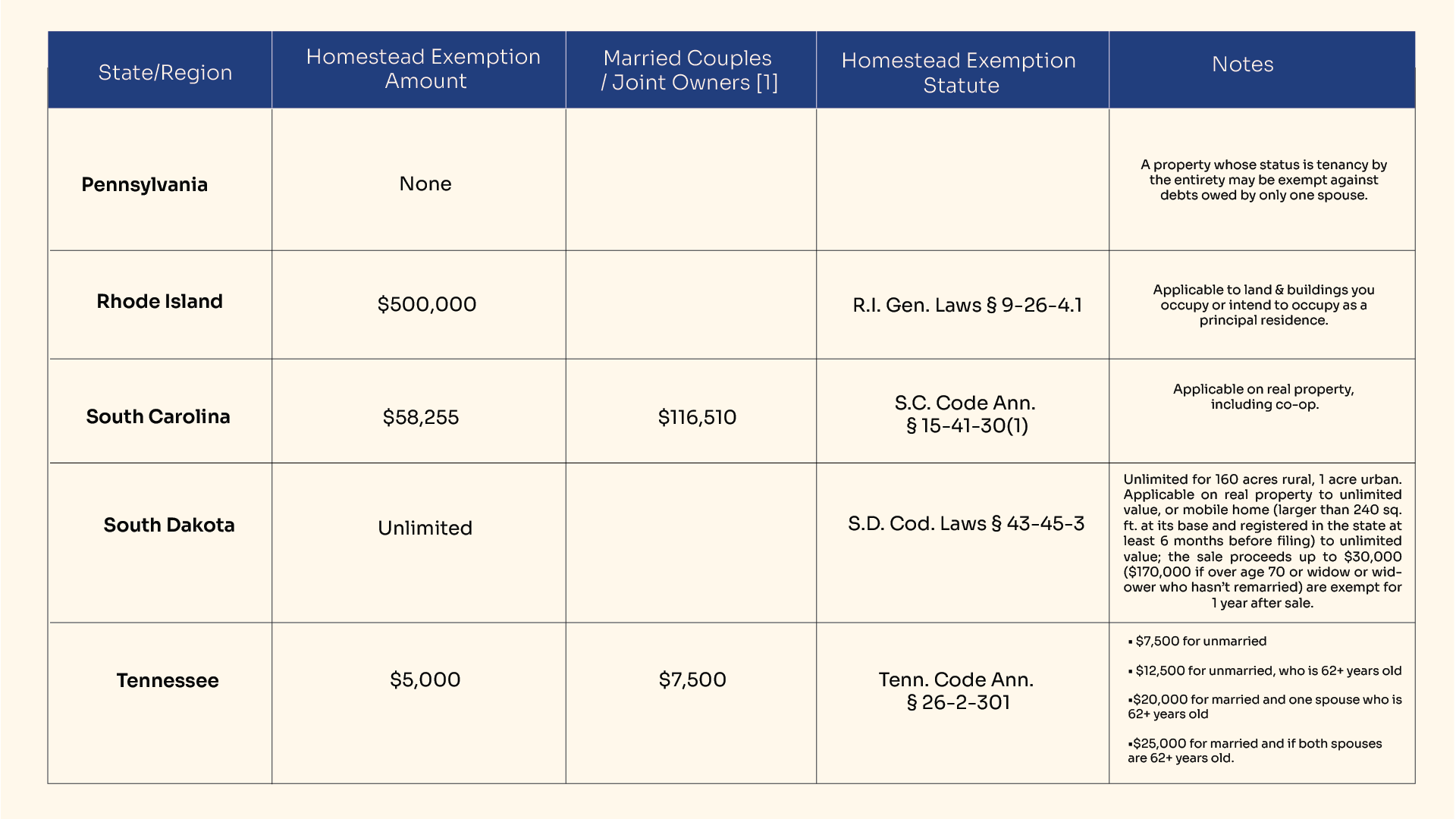

Homestead Exemptions by State in USA in 2025 Bezit.co, Day mo1343 indefinitely postpone filed; The nebraska department of revenue, property assessment division (dor) reminds property owners that the nebraska homestead exemption application,.

Webinar The Basics of Nebraska Property Tax and Homestead Exemption, Code §704.730 allows for a minimum homestead exemption of $300,000 and a maximum of the median sale price. You must file between february 1st and june 30th every year in the assessor's.

Fillable Online Nebraska Homestead Exemption Application Application, Over 65 applicant qualifies for 100% based on the income criteria. Accept and process homestead exemption applications.

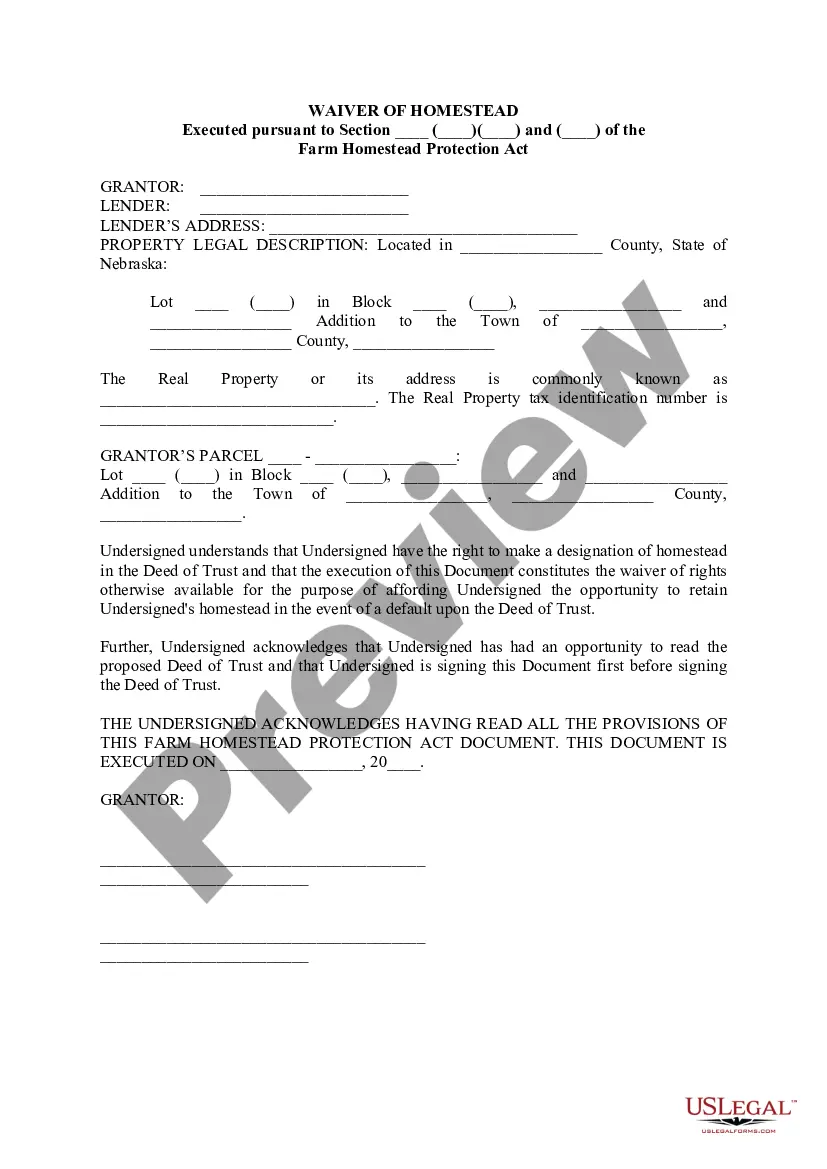

Nebraska Waiver of Homestead pursuant to Farm Homestead Protection Act, On january 18, 2025 in the legislature: The nebraska department of revenue, property assessment division (department) reminds property owners that the nebraska.

Nebraska Homestead Exemption Omaha Homes For Sale, The nebraska department of revenue, property assessment division (department) reminds property owners that the nebraska homestead exemption. Day mo1343 indefinitely postpone filed;

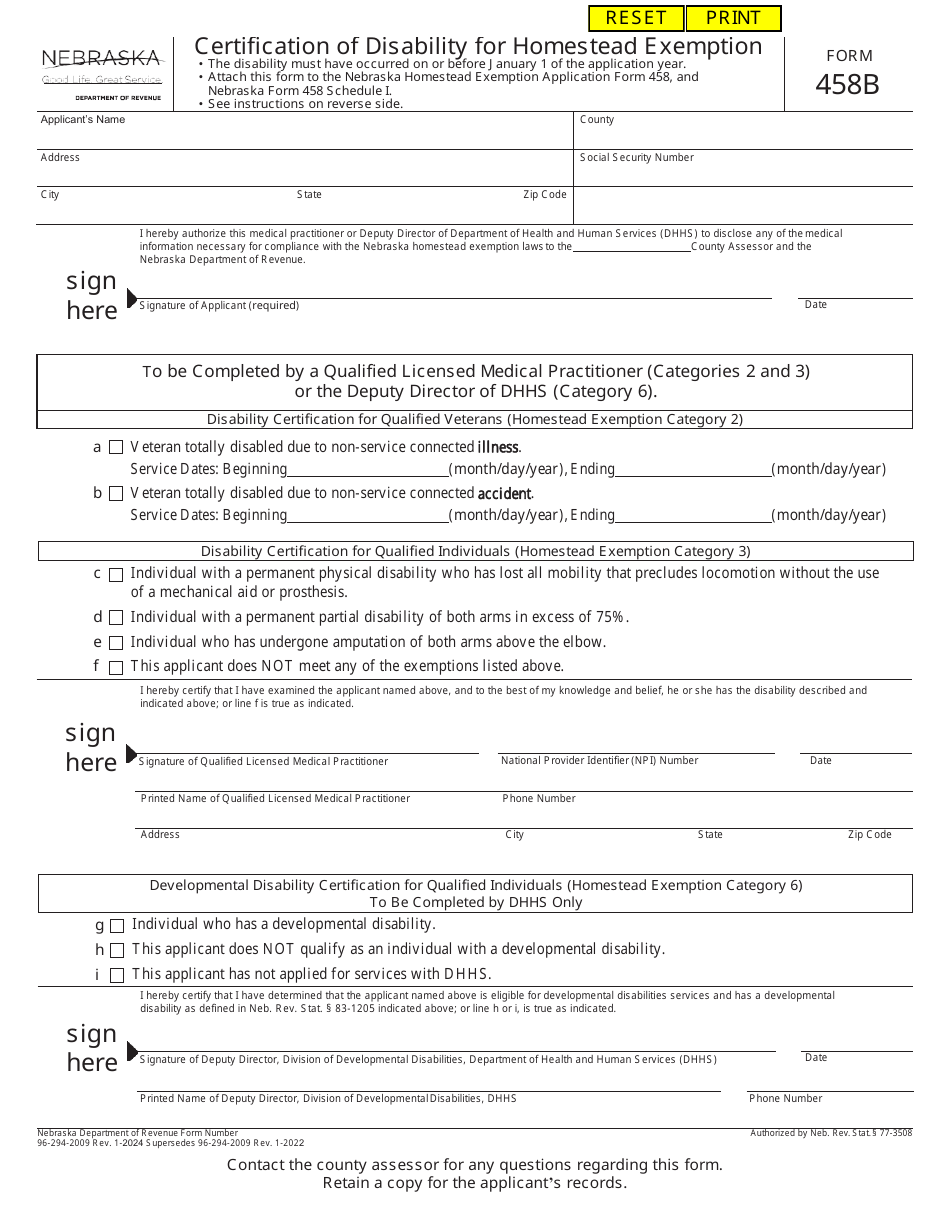

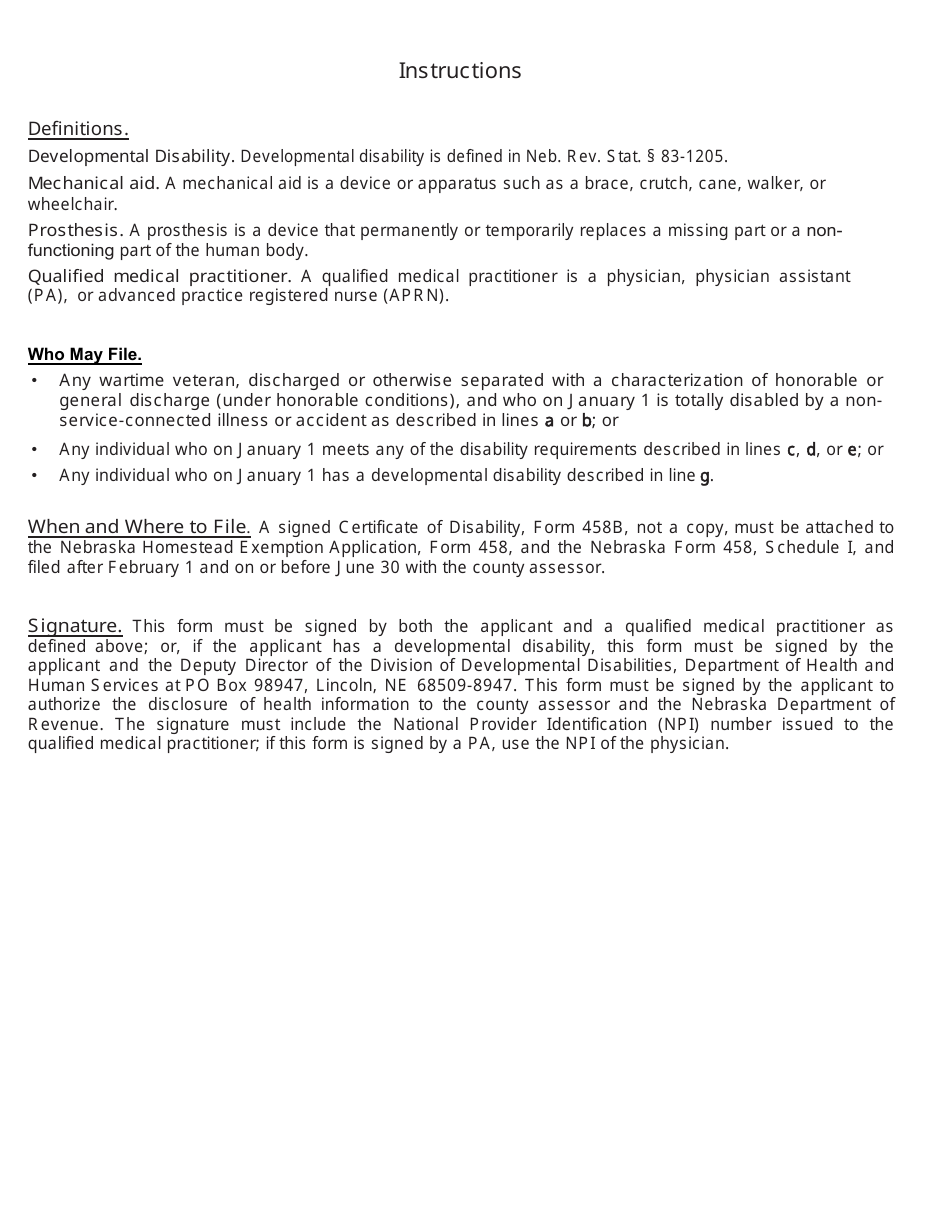

Form 458B Download Fillable PDF or Fill Online Certification of, If you have not yet filed your 2025 nebraska homestead exemption application, you may still be eligible to apply for a property tax exemption. The state of nebraska reimburses the.

Form 458B Download Fillable PDF or Fill Online Certification of, Respond to requests for information from the public. As of january 1, 2025, cal.

Fillable Online Nebraska Homestead Exemption Application, Code §704.730 allows for a minimum homestead exemption of $300,000 and a maximum of the median sale price. The nebraska homestead exemption program is a property tax relief program that reduces all or a portion of taxes for homeowners in nebraska who occupy a home, used as their.

The homestead exemption provides relief from property taxes by exempting all or a portion of the taxable value of the residence.